U S. Bank account legal casino for Canadians

Posts

The new low-money charity, California Peace Officers’ Art gallery Base, have approved the brand new privilege and responsibility out of keeping a memorial to own fallen officials on the Condition Capitol foundation. On the part of you plus the law-abiding people of California, thank you for your involvement. The new house otherwise trust could make volunteer benefits out of $step 1 or even more in whole dollar numbers to the money listed within point to your Form 541, Top 4. You do not use the Estimated Have fun with Income tax Lookup Desk in order to imagine and you may report use income tax owed to the orders away from issues for usage on your team otherwise on the orders away from private low-organization issues bought for $step one,000 or more per.

In the year your expatriate, you are at the mercy of tax online unrealized get (or losses) in your assets because if the property ended up being ended up selling to have their reasonable market value at the time prior to your expatriation date (“mark-to-industry tax”). Which relates to extremely sort of assets passions your kept for the the new date from relinquishment from citizenship otherwise termination out of abode. If you make the option, you could potentially claim write-offs due to the actual assets money and you may merely the net income of real property try taxed.

Range 20b – ESBT nonexempt earnings | legal casino

That is genuine even if you are a good nonresident alien electing so you can file a shared return, since the said inside the section 1. With regards to the twelve months the spot where the U.S. revenues is actually attained, Form are often used to consult a decrease in withholding. Withholding may be needed even if the income can be excused out of taxation by specifications away from a tax treaty. You to definitely reason for this can be that limited or over exemption is often considering items that simply cannot become determined up to once the newest intimate of the income tax season. Moreover it comes with 85% away from social security professionals repaid to help you nonresident aliens. An individual (or inactive person) that is (or is actually) a great nonresident noncitizen of your own United states to have property and you can gift income tax aim may still provides You.S. house and current taxation processing and you may fee personal debt.

Staff of Foreign Governments

There are no special regulations to own nonresident aliens for purposes of More Medicare Tax. Wages, RRTA compensation, and you can mind-a job income that are at the mercy of Medicare tax is likewise susceptible to Additional Medicare Taxation when the in excess of the brand new applicable endurance. Generally speaking, You.S. societal defense and you will Medicare taxes apply at money out of wages to have features performed because the a worker in the us, regardless of the citizenship or home from either the newest employee otherwise the newest employer.

Should your fiduciary will not document a twelve months tax get legal casino back, it ought to enter the taxable 12 months regarding the place in the finest out of Form 541. Complete Mode 540 using the tax rate plan to have a wedded people filing separately to figure the fresh tax. Don’t include the simple deduction whenever completing Function 540. Go into the complete tax from Form 540, range 65, to the Function 541, line twenty eight, and you will complete the rest of Function 541. In the event the IRC Section 965 were said to have federal intentions, produce “IRC 965” on top of their Ca taxation get back.

You’ll want registered the go back by the deadline (along with extensions) to be eligible for which quicker punishment. Unless you spend your taxation from the brand-new due time of your get back, you are going to are obligated to pay focus to your outstanding tax and could owe charges. Unless you pay the tax from the brand-new owed date of your own come back, you are going to are obligated to pay interest for the outstanding taxation and may also owe charges.. Once you profile your own You.S. income tax for a dual-position seasons, you are at the mercy of some other laws and regulations to the the main 12 months you are a citizen as well as the area of the year you’re a nonresident. For those who as well as your companion did not have SSNs awarded to the otherwise through to the due date of the 2024 return (in addition to extensions), you can’t claim the newest EIC for the possibly your unique or an revised 2024 come back.

Federal and state Fiduciary Versions

They are more common things in which Function 8833 are expected. Self-working someone can be necessary to shell out Extra Medicare Taxation. If any one to company deducted more than $10,453.20, you can’t claim a card for the number. In case your boss cannot refund the additional, you might file a claim to have reimburse having fun with Function 843. 515 and you will Internal revenue service.gov/Individuals/International-Taxpayers/Withholding-Licenses to own information about procedures to help you consult a good withholding certification.

Inside each individual country, several additional quick put amounts is actually popular. These vary a bit from spot to set and you can currency to help you currency. Right here we are going to guide you and therefore accounts will be the most widely used web site inside every part of the globe as the minimal deposit gambling enterprise amounts are managed a tiny differently inside the for every put.

You will still you desire good credit for this choice, however you will never be required to shell out as much initial. In case your credit are limited or if you provides other problems, you may need to consider delivering a rent guarantor. Clients in the usa hand over $forty five million of the discounts in the way of shelter places to help you landlords each year. Supply the final amount away from California resident trustees and the complete amount of Ca nonresident trustees whom offered the newest faith during the any part of the trust’s nonexempt season. Income of Ca offer is nonexempt no matter what house from the newest fiduciaries and you can beneficiaries. Contingent beneficiaries aren’t associated within the deciding the fresh taxability from a great believe.

Shelter deposit legislation — state because of the county

- While you are utilized in one of the following the kinds, you do not have to find a cruising or deviation permit before you leave the us.

- This article explores all about security places, the rights for the protection put reimburse, and choice alternatives for protecting the protection put when you are financially confronted.

- See Public Shelter and you can Medicare Taxes in the chapter 8 for lots more information.

- Property managers will most likely not fees a safety put that’s a lot more than just two months away from rent repayments.

- You must signal and you may go out so it report you need to include an announcement that it’s made under punishment from perjury.

- You can even qualify for the newest exclusion described a lot more than if the all of the next apply.

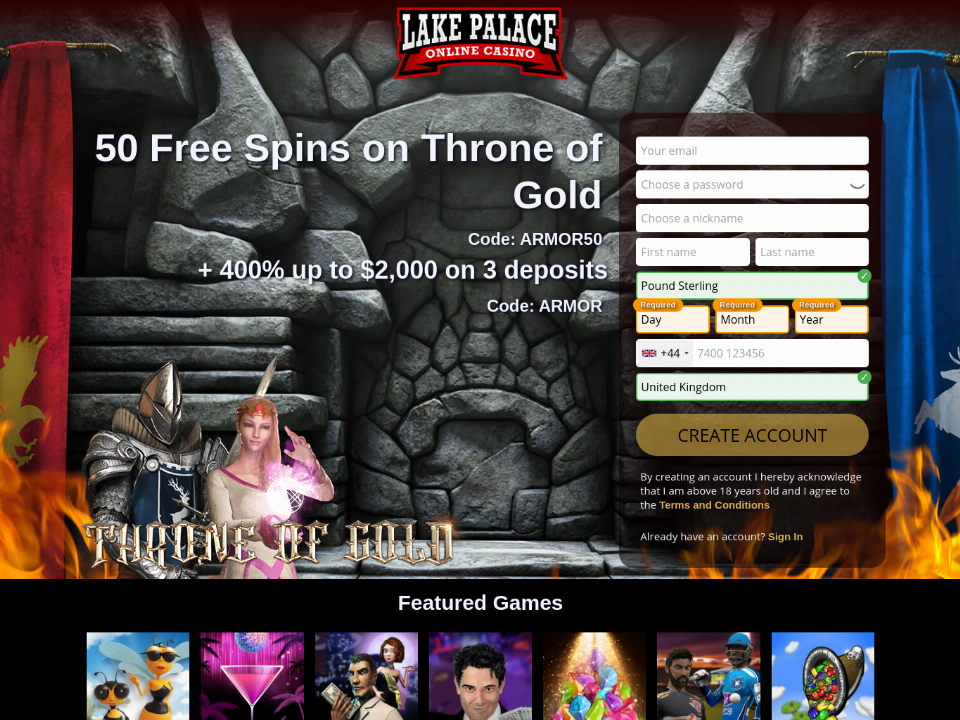

The fresh RTP for Skyrocket Casino are 96.38% and it also have an excellent Curaçao licenses – you are aware we recommend using signed up gambling enterprises simply. Wagering criteria is actually 35x, that have a maximum bet of 7 CAD during the betting. The most cashout is actually 1500 CAD, and all of wagering need to be accomplished within 5 days. The main benefit will likely be triggered immediately after joining an account because of the entering the new promo code on the incentive web page, searching for they throughout the deposit, and you may making the commission. Score a great 100% fits extra up to 800 CAD and 80 100 percent free revolves for the Sunrays away from Egypt 3 from the step three Oaks during the OnlyWin.

Bob and you can Sharon both choose to be managed while the resident aliens by the checking the right package on the Function 1040 or 1040-SR and tying a statement on the combined return. Bob and Sharon must file a shared get back to the 12 months they generate the possibility, but they is file sometimes mutual or independent production to own after ages. If one makes this program, you and your partner is treated to have taxation objectives while the owners for your whole income tax year. None your nor your wife can also be allege less than people tax treaty never to become a great U.S. citizen. You must file a combined income tax go back for the seasons you make the possibility, however as well as your mate is file combined otherwise separate efficiency inside the senior years. Keeping track of costs, landlords are using on the web apps to collect security places, lease, and you can charges.

The content in this post is exact at the time of the newest post date; however, a number of the now offers mentioned could have ended. Banks always give t-shirts and you can toasters to get new customers to open up an account. This web site has hitched with CardRatings in regards to our visibility away from borrowing from the bank card items. Your website and CardRatings will get receive a commission away from card providers. Opinions, reviews, analyses & guidance will be the author’s by yourself and also have not started analyzed, recommended or approved by any of these agencies.

The guidelines chatted about here affect both resident and you may nonresident aliens. While you are needed to document a You.S. federal income tax come back, you happen to be permitted some special emergency-relevant regulations about your use of senior years fund. On the state away from Connecticut, a security deposit is not felt taxable money in case it is very first gotten—because it’s not quickly sensed money. The reason being the home director you’ll still have to reimburse the protection deposit to your citizen. And you can a cards partnership to possess group at the Harvard University has had a really book approach to the problem, providing a no %-attention financing to cover swinging expenditures since the an employee work with.